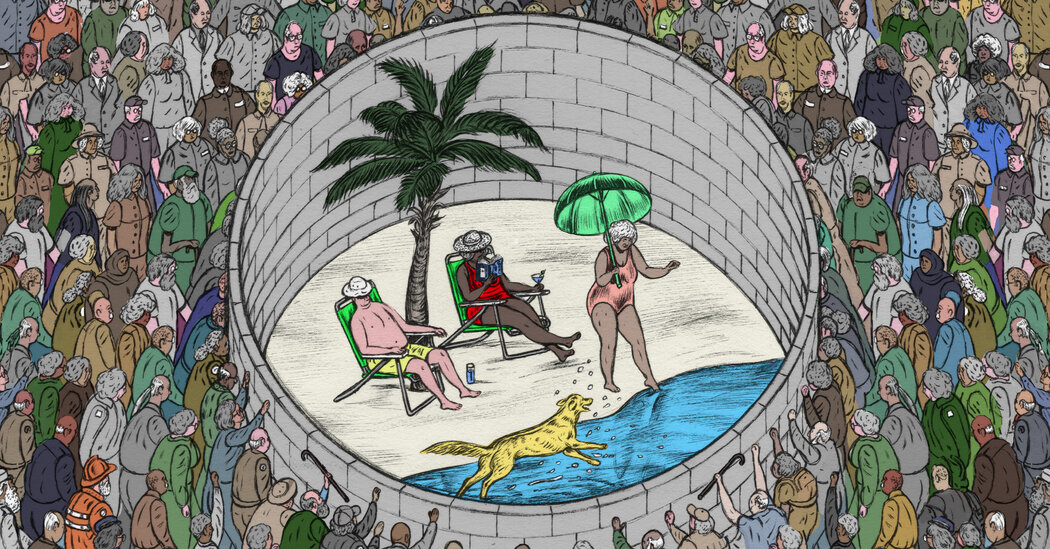

401ks weren’t a “mistake” they were designed to give wallstreet traders more money and for that task they have succeeded extremely well.

e: To the tune of $7trillion according to the article.

I like how you got downvoted. This is 1000% true.

How do you think pension plans make money? They are managed by fiduciaries responsible for investing. Guess where they invest. 20% of the stock market is owned by pension funds :https://retiregenz.com/what-percentage-of-the-stock-market-is-owned-by-pension-funds/

So my employer did this thing where new hires automatically got enrolled in a 401k. If you did absolutely nothing to your 401k, each year it would automatically up your percentage to a max of Y. Is that common or uncommon? And in this world of 401k over pension, should that be more of a norm to help protect people that don’t know better build retirement savings. It doesn’t solve the problem of folks not having enough money and needing to use 401k for emergency funds…

I aways assumed a 401k was what americans called pensions, like gas and petrol. What is a 401K if not a pension?

They’re similar in that you use it for retirement.

But, 401ks you contribute to and the value depends on the stock market.

Pensions you don’t contribute to and the amount you get is fixed.

More here: https://www.forbes.com/advisor/retirement/pension-vs-401k/

Oh interesting, where I am both of those are pensions but one is called defined benefit pension and the other a defined contribution. Mt wife has a defined benefit whereas I have contribution.

Benefit is definitelt better, knowing what you will definitely have is ideal and you can still take full advantage of a DC scheme if you want.

You’ll generally get less from a defined benefit plan vs a defined contribution plan. A defined benefit plan is an insurance product, so the managers are encouraged to be more conservative with investments to limit risk. A defined contribution plan is an investment product, so the managers are encouraged to maximize returns.

Would you rather have a 5% yield guarantee or a very high chance at 10% return? (as in, 10% has been consistent in the past) In almost every scenario, a defined benefit plan will have much lower usable cash and no inheritance vs a defined contribution plan.

The US actually has both. Social Security is a defined benefit plan, and a 401k is defined contribution. Social Security is intended to replace ~40% of pre-retirement income (more for lower income, less for higher income), and the 401k is intended to fill in the gaps.