It’s a low amount though (2000*36=€72k). What is more concerning is his 50,610 shares that he sold in total in the past year, as now that is a fairly big amount if he planned this move many months ago.

To be fair, these guys are much more suspicious:

Chief among them being Tomer Bar-Zeev, Unity’s president of growth, who sold 37,500 shares on September 1 for roughly $1,406,250, and board director Shlomo Dovrat, who sold 68,454 shares on August 30 for around $2,576,608.

EDIT:

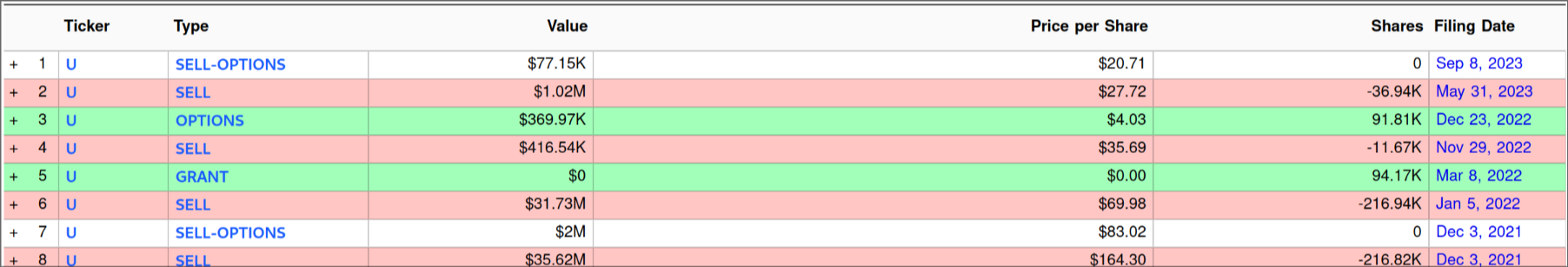

Yeah, nothing really unusual in Riccitiello’s trades. He may be an asshole but that’s no reason to immediately accuse him of insider trading for a lousy $77.15k worth of shares given that he already has a pattern of selling way bigger amounts:

EDIT 2:

Here’s Riccitiello’s filing for that trade: https://www.secform4.com/filings/1810806/0001810806-23-000163.htm

Read in particular this part:

( 2 )The sales reported on this Form 4 were effected pursuant to a Rule 10b5-1 trading plan adopted by the Reporting Person on May 19, 2023.

That’s not insider trading. That’s a pre-planned trade (see Investopedia’s entry about Rule 10b5-1) that would have been executed no matter what.

I’m glad to see some light being shined on the taint rather than it all on the asshole.

Yeah, 2000 is nothing compared to the 50k shares he sold already. I think the bigger data point is probably how many shares does he own in total. It’s not uncommon to diversity and minimize some exposure to one company. Give stock is a major compensation structure for ceo’s, it makes sense they they liquidate it at periodically. I’m curious is September 1 is a vesting day or something for stock awards.

deleted by creator

It can be a pre-planned trade. However they also could have waited for the shares to be sold then make the announcement.

Who knows. I’m not here as a judge.

never found the trades themselves suspicious (scheduled vesting) but the timing of their announcement, which JR had complete control over, is a bit fucky. Consider they edited the wiki in mid June. Then wait two months to announce a huge policy change, right after everyone that was getting out had already gotten gone.

Come on people you’re all staring at flashing LEDs distracting you and you’re ignoring the giant spolight of Riccitiello’s ownership of over 400,000 EA shares.

He moved the EA stock price by 2 dollars the day they announced the Unity deal.

Unity did a bad thing, but the stock sale here is a complete non-event.

According to Guru Focus, Unity CEO John Riccitiello, one of the highest-paid bosses in gaming, sold 2,000 Unity shares on September 6, a week prior to its September 12 announcement. Guru Focus notes that this follows a trend, reporting that Riccitiello has sold a total of 50,610 shares this year, and purchased none.

He receives and sells stock constantly, as do most execs of publicly traded companies. Their compensation is majority stock, which incentivizes them to maximize stock prices since a higher price means more money RIGHT NOW for them. Look up any publicly traded company and peek at their insider trading info. Microsoft as a random reference and here’s Unity so you can see everyone else and the long term trends.

The piece cites Guru Focus as their source of this info as if they have some keen inside information or something, but it’s literally public data that anyone with an internet connection can look up as these sorts of notices are required for publicly traded companies. Riccitiello only sold about $83k worth of stock before the announcement for a total of about $1.1M worth of stock this year, vs about $33M last year, and close to $100M in 2021. The idea that he dumped $83k worth of stock to beat bad news Unity was dropping is just a hilariously bad take.

Pretty much every smoking gun insider trading story trending in social media.

Some rat-off-sinking-ship move? Only in this case the rat also was responsible for the sinking, and leaves with a pile of cash? But then I’m no expert in neither gaming nor stocks, nor ships.

Watching turbo capitalism eat itself live and in colour is rad.

I’m no expert either, but this could be a deliberate exit plan that CEOs do, or if he plans to stick around, it could be a deliberate ploy to buy back shares at a lower price - so even if he bought back everything he sold, he’d be making a big profit. Could also be combined with a ploy to introduce the actual pricing plan they wanted to implement all along, and when they implement it, it won’t seem so bad combined to what they’ve proposed currently, and people, especially those deeply invested in the Unity ecosystem, will lap it up.

Or like most CEOs all his trading is done by a 3rd party so there is no conflict of interest

Sadly none of these options seem to add anything of tangible quality to actual life, just yet another bit of scamming people out of money somehow to add to the general dystopian vibe.

Of course, that’s what I was getting it. It’s highly unlikely that all of this wasn’t pre-planned, this stuff is taken right out of the modern CEO playbook.

Isn’t that what executives usually do?

Unity’s president of growth, who sold 37,500 shares on September 1 for roughly $1,406,250, and board director Shlomo Dovrat, who sold 68,454 shares on August 30 for around $2,576,608.

You could buy an f-35 fighter jet in myrtle beach for that kind of money.

You could buy a cockpit handle for that much

No, that’s the total price, not the price per share. An F-35 is like 10 to 30B, isn’t it?

Not in Myrtle Beach it isn’t, that’s the point. Might want to look up F-35 news hehe.

Lol no. Its cost is around the 150 million mark

still, that’s 2 orders of magnitude off

Twitter, Reddit, Netflix, Unity, we keep asking why these corporations are so greedy, but we know the answer. Because we let them be.

Why shouldn’t Google sell your porn history to the Saudis and Russians? Is your use of their search engine/apps going to change if they do? Even if it does, does it effect their sales? Are they actually going to be held accountable for their scumbag actions? Why should they give the slightest FUCK about you, if you’re never going to cause a problem for them?

No. They’re not.

I’m not really sure what to make of this - I’ve been hearing people both bring up that he sold stock in isolation, and I’ve heard others say this is part of a routine pre-planned stock sale. Presuming he’s not performing obvious inside trading, I imagine it’s the latter.

I know capitalism bad and unity CEO bad, but is there actually anything to this? If not, why does this keep getting brought up? (I mean this as an actual question, not loaded)

There’s nothing to this individual sale, it’s just “CEO bad”. Given that apparently he’s had a bunch of sales planned for a while, it suggests he thinks the share price isn’t going to increase over that time.

I’m not a financial expert, but in my layperson opinion, I’d say at the very least, it is suspicious and needs to be investigated.

Going by this commenter this seems like a nothing burger.

Obviously, fuck this CEO for all he’s having occur to Unity, but the stock sale doesn’t ultimately seem that important or relevant.

deleted by creator

Because for some reason, our entire economy is built on short term profit rather than longevity and stability.

deleted by creator

Stock market is dependent on news rather than actual business. Good news is difficult to develop and requires actual work to be done.

Bad news travels faster, produces definite effects and gains immediate response and profit.

What’s the worst that could happen, a company would go under. The vultures have already eaten their share and have made a killing in the death of the company.

Who cares about the losers the consumers and the workers.

The only good thing one can hope is for increased support for open source alternatives which are just there but not good enough for production.

They likely think it will be bad in the short term.

This should be beyond illegal.

This kind of white collar crime should be punishable in days for dollars.

Afaik, it is. This news is blown out of proportion. Getting an approval to sell your shares takes like half a year, so these were actually sold way in advance. And he sold basically a couple of shares, compared to what he still holds. They are still scummy, but this is just an attention grabbing article.

The saddest bit is the staggering numbers of non-wealthy Americans who insist our economy isn’t completely rigged against them and rigged for existing capital holders, as if sucking up will grant them access into the little club doing the rigging one day.

They’re the poor deluded bastards that keep us stuck in it. “This is fine haha! I’ll fight you if you try to improve how fine it is haha! Give our glorious job creators everything and pray for rain haha!”

He knows.

Why do we let execs sell stock received as compensation at all?

They literally take out tax free loans with the stocks as collateral. Dodging the entire capital gains system.

Because stock you can’t sell is worthless.

It’s worth whatever it sells for when you resign. Which, if you did a good job, is way more than what it would’ve sold for the day you got it.

If you’re doing a good job, though, why would you want to resign?

And if, for reasons beyond their control, the stock price is going to fall (e.g. new international tariffs or something), why should they be handcuffed to that decrease in value?

Did he also update his resume, book a moving company and buy a first class plane ticket?

How is this not insider trading?

Because it’s scheduled. He probably just has a “sell all of my stock bonuses as I receive them” order to his broker. If he doesn’t actually get involved in the day-to-day decision making of his stock portfolio, then there’s no special knowledge involved in the sale.

he didn’t have control over the trades, but he controlled the timing of the announcement entirely.

they knew since june (when the TOS was edited), but waited until last week to drop their stinker of a plan after everyone had already cashed out what they wanted to.

almightysnoo above posted this, which I think is revealing:

Chief among them being Tomer Bar-Zeev, Unity’s president of growth, who sold 37,500 shares on September 1 for roughly $1,406,250, and board director Shlomo Dovrat, who sold 68,454 shares on August 30 for around $2,576,608.

That makes sense. Thought there would be a reasonable explanation for it.