Because the ‘numbers’ that neoliberals have decided are the indicators of a “good” economy mean almost nothing to, in all likely hood, 95% of Americans.

Measuring the right thing leads to inconvenient conclusions (age till retirement, income at retirement, income independence, buying power, home ownership, business ownership, union membership, etc.)

Bloody well hate the neoliberals. One was arguing with me on reddit that because people in Kenya are better off, compared to the 80s, I should stop complaining.

Like ok I am happy for the people of Kenya. I got nothing against them. So yeah good job. Now can my healthcare costs please go down? Because I am pretty confident that they can and the people of Kenya can also be doing well. One really doesn’t impact the other that much.

No, you see, because TVs have gotten consistently cheaper (they’re like the only thing to have done so), everything’s working!

And the main reason they’re cheaper is because all of them are data harvesting machines. What a fun world where even your habits are a commodity!

Like they even give a shit about Kenya. Just blatant manipulation.

I love that they chose a term to further muddy the waters between conservatives and liberals.

I hear neoliberal and I think, “huh, is the a new liberal?” Nope. It’s the exact fucking opposite.

That term isn’t new nor is it meant to muddy any waters. Liberals are not leftists.

That’s exactly what leftists are. The left is liberal. The right is conservative.

Outside the US, “liberal” often means “libertarian”, not leftist. The Liberals in the UK and in Australia are very pro-business. The leftist parties in both countries, and elsewhere, call themselves “Labor” not “Liberal”.

In the US, “neo-liberals” often refers to people who wanted to install pro-business regimes in other countries, like Iraq…

Whenever you see reference to neoliberalism or someone mentions ‘leftists’ relative to ‘liberals’ it is in context with classical liberalism.

The wiki page is a pretty good jumping off point to understand some of the distinctions and discourse.

No, the left is socialist, the center is liberal, the right is conservative

Fuck neoliberalism. Glad I found out what it was. It really highlights everything that is wrong with the American economy.

… because my purchasing power is much lower than two years ago and my wages aren’t remotely keeping up with profiteering inflation? Because I have to be very careful around Christmas to not overspend and I get to explain to the kids why there’s only a few presents under the tree? They’ll be okay with it, but as a person who has children to take care of it, it’s crushing to go backwards year to year in what you’re able to provide? Because a 3/4 full shopping cart today (not much meat) was $179 today? And we have a fixed rate mortgage! I can’t envision the pressures people who are renting or trying to buy a home right now are going through. Anyone saying “it’s all good out there!” can get fucked.

No kids to take care of, but my fridge just went out today. This spoiled most of the food in the fridge as I can’t pick up a new one until tomorrow, and the of a new fridge and restocking my fridge pretty much cancels Xmas gifts for the family. I feel bad every year because they get my wife and I all kinds of cool stuff and it seems like every year I’m stuck telling them, “Maybe I’ll be less broke next year” Not quite the same, I know, but it still makes me feel aweful…

Meanwhile the owner of my company just bought a 5th wheel camper trailer and hitch for his truck in June because he felt like going camping, and is having a 6 bedroom house built for his son on his ranch because his sons wife is having a baby.

This world is fucked for the working class truly.

If it isn’t too late. Buy an absolute fuck ton of ice. It’ll keep the food cold enough.

This isn’t probably what you want to hear right now, but I’ve been much happier giving homemade gifts to family and friends. I found a couple of things people really enjoy that I make and they all look forward to it every year. For me, it’s pork jerky. That might not work for you because you need a dehydrator but I can post the recipe if you want. It’s a lot of work so no one ever makes it, but when they receive it for Christmas they know I put a lot of time and love in and I really think that’s what Christmas should be about. It’s really cheap… Mostly two or three large pork loins covers my entire Christmas list.

Other family members have started to do the same. My brother makes really good homemade caramel popcorn. My sister made some rum infusion to give out. Another sister even one time even made Dominoes somehow with resin.

If you are able to find time and energy to spread your love for your family and friends Christmas is a lot of fun.

This is a great idea! But I will have to go with something other than meat. A fair amount of my wife’s side of the family is vegetarian. I’m also not that great at cooking lol one of my thoughts this year was to do some of my stencil spraypaints on canvas, as I have a huge stock of canvases and spray paint I never used when I stopped doing it years ago. I just wish I had more time to create some stencils.

Wait… All your food spoiled in a single day? Was your fridge made of cardboard? It should be able to remain cold for at least a day, probably 2-3.

It’s from 1986 and not insulated well. Between that and my wife keeping the thermostat and mordor temp, and opening the fridge for long periods of time not knowing it wasn’t working, it turned into a hotbox.

I can’t believe how expensive thanksgiving shopping was this year. I hit nearly 200 dollars.

We hit $200 very easily just buying household essentials, it seems like. Heaven help us if we need paper towels, toilet paper, contact solution, the ‘cheap’ shampoo and conditioner, plus a few cleaning supplies all at the same time. $200 comes at you fast on those shopping days.

Dang, I was just thinking about how my mom got a raise years ago when I was still a kid and it practically changed our life. All of a sudden we were eating out more. All of a sudden we had nicer things. All of a sudden my mom wasn’t stressed anymore.

It’s sad to see how people are now experiencing the opposite of that. It’s sad they’re experiencing that when, in absolute terms, we are more productive than ever.

Greed really is the worst thing we face as a species in the modern age. It’s a shame so many people are gung-ho about supporting it.

The disparity in wealth needs to shrink instead of grow. Otherwise, these problems will only get worse over time.

I feel like I have been seeing the same article once a month since 2007.

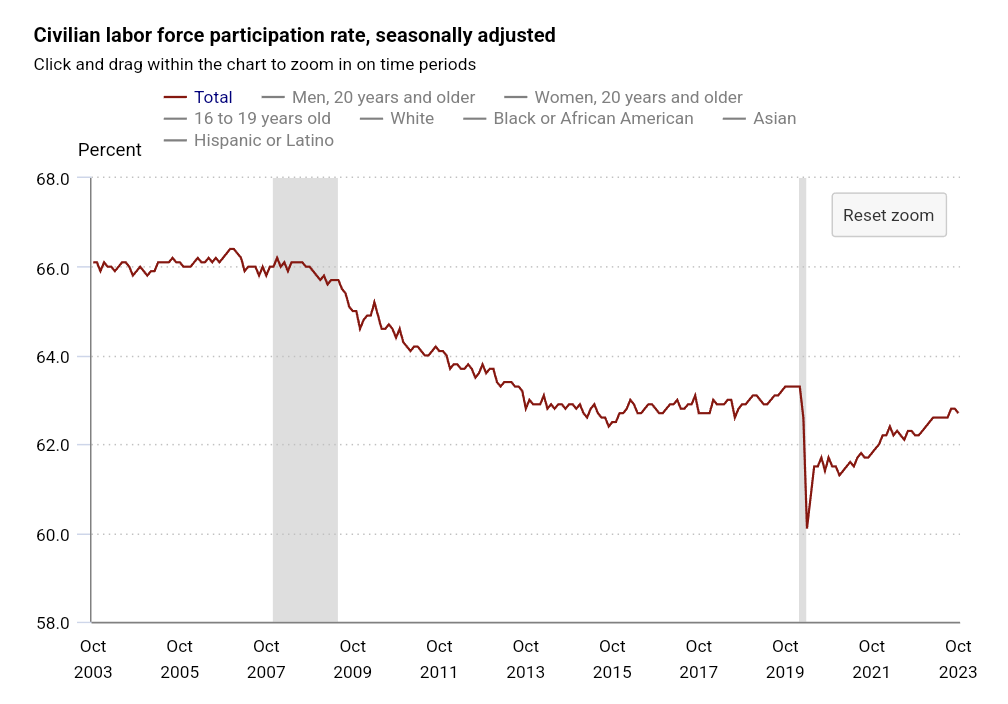

A. Unemployment numbers are basically a lie at this point. The only number that comes even close to representating the situation is the workforce participation rate. Question: what percent of people are employed? Answer: what percent of people are employed. It is simple as that. If you look at pretty much every month the US hits a new low. Over a third of the adult population did not earn $20 dollars last week. There was a slight trending down right before 2007 crash but not significant. A deep dive into the numbers shows that this is not the result of retirement, it is the result of prime working age males dropping out.

B. Who cares if inflation is low at this moment? That is like arguing that everything is fine the previous 5 minutes when a car crash happened 6 minutes ago.

Peices of garbage keep telling us that everything is fine when it fucking isnt

I really like that car crash analogy or whatever you want to call it. It isn’t like sudden positive changes in inflation or job numbers magically fixes QOL for people overnight. It can take weeks…months, maybe even years (maybe even never?)

This is it exactly. Positive changes in inflation mean prices aren’t going up as fast. They’re still going up. They’re never going to go down because businesses don’t charge less when the alternative is making more money. They only ever charge more with inflation.

Checks out. Not a huge change but a definite trend.

Source: https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

Corporate profits ≠ my wallet

Corporate profits <- your wallet

Because it’s a bullshit narrative. Cost of living keeps going up. But inflation doesn’t count rent, groceries, or gas.

For what it’s worth gas has come down quite a bit the last few weeks.

deleted by creator

Rent is going to go up as long as it’s able.

As soon as people have more money to spend, landlords increase rent.

Renting is one of the biggest scams this generation has convinced itself into falling for.

I wasn’t able to afford to buy a house until I was over 50 years old, it took a global pandemic, a complete shutdown of the economy, and working from home for multiple years to bank the cash to make it happen.

People don’t rent because they CHOOSE to.

How much was your house?

Listed for $374,000, but I had to bid up to $390,000 to get it.

Yeah, you didn’t have to spend anywhere near that much.

But you wanted to, so you did.

To buy a house where I live, that’s a bargain!

Yeah, there are plenty of other places you can live though.

lol yeah dude, I convinced myself to rent

I mean, you live in a major city so yeah.

You’re probably never going to leave major cities, nor are you ever going to own property in them.

Yeah. You convinced yourself to rent.

I live in rural Iowa wtf are you talking about? We rent out here too!

I actually am paying off my trailer, though, so someday I could maybe put this on a piece of rural property somewhere and do remote work or something? But like, I never chose this shit - I just stayed where I grew up and got a factory job when my neurosis and undiagnosed dysphoria caused me to flunk out of college. I guess I could go squat in the woods though lol

Its pretty insane we don’t invest in our cities anymore when they’re the powerhouse of the economy. Not to mention they’re a way better use of land than suburbs and rural living. You can find affordable places in Tokyo and so many other cities worldwide that dwarf ours in almost every metric. Cities really aren’t the problem, they are actually the potential solution if we change our policies around them and attempt to catch up with countries like Japan.

This generation? Fucking Romans were complaining about high rent for shitty apartments over 2000 years ago. Don’t be a dumbass.

Right… and no generation since has ever seen the value of owning property, right? Lol.

Mark Twain was right. It’s easier to fool someone than to convince them they’d been fooled.

See how mad people get in this comment section when someone points out they’re being taken for a ride? One person even said they won’t get off the ride if it isn’t “easy.” Lol.

Supply and demand. You’re not exempt from them.

Right… and no generation since has ever seen the value of owning property, right? Lol.

Are you under the impression that modern renters are choosing to rent instead of own?

60% of Americans live paycheck to paycheck making saving for a down payment impossible for over half the country, and with rates being what they are, mortgages are expensive af.

People are renting because it’s the only way to live, not because they think it’s neat. People are getting upset at you not because you’re pointing out that rent is a scam, but because you’re implying it’s the fault of the victims

Quoting someone much smarter than you doesn’t enhance your unintelligible argument. It makes it dramatically worse.

Oh boy, we got one.

slaps forehead wait I can just buy a house? What a solution!! So easy!

You are being sarcastic but a lot of people who are convinced they can’t afford it actually could afford to own the place they rent and have just never crunched the numbers.

Before the rate hike this was probably true, but most areas haven’t adjusted to people having about 100k less buying power.

I never said it would be easy.

Do you only do things if they are easy?

I make about $75k a year, but to afford a $700k house (which is a “reasonable” price) near my city (Seattle), I’d have to make $150k per year. The only affordable houses are two hours’ drive away, and there are no “starter” homes to buy. I can skrimp and save for the rest of my life (and I am). But unless I get a huge raise (and I’m already above the median national income), buying a house is impossible. Not just hard, economically impossible.

Have you tried just making more money?

Jeez, you poors are just so lazy.

(I really wish this weren’t needed, but I think it is) \s

I’m also in Seattle and it’s bad out here. I was looking at townhouses last year before the rates went up but couldn’t get a mortgage because of a limited amount of work experience since getting my second degree during the pandemic. I was actually surprised that I could have afforded a decent townhouse in like Edmonds or Shoreline until the rates shot up - going from 3.5% to 7% adds something like $1000 a month in interest on a $400k mortgage. Then I realized I have never lived alone before and wasn’t sure if buying a place was the best way to try that out lol. Average rent in Seattle right now though is like $2300-$2400 a month which is close to 50% of the take-home income of someone making $100,000 per year. It’s insane.

Hold on everyone, this 17 year old is gonna explain why we’re all idiots

Because interest rates are insane trapping people in homes they no longer want but can’t afford to leave?

Speaking of… My car got totalled at the end of October, shopping for a new one, I saw interest rates for me between 7 and 8%, for other folks, I saw one as high as 12.25%(!) On a CAR LOAN.

Because interest rates are insane trapping people in homes they no longer want but can’t afford to leave?

I’m in this comment and I don’t like it.

Least you got a home. I am on a very long lease and landlord is getting offers. I got about 2.5 years until someone just offers him a million bucks in cash. Then I am out thousands of dollars in moving expense plus changing my kids school. Plan to fight it but I am sure I will lose.

Sorry bro.

Try to own property as quickly as you can. Unfortunately, even the market for that has gone to shit thanks to investment companies.

This is what we get for breeding for greed. Gotta stop rewarding shitbags just because they have money and start holding them accountable for how they got it.

It won’t happen, though, lol. These problems won’t get solved just like global warming 🤷. We don’t want to solve them.

Well there’s one way to solve these problems 🤠👉

Yeah, I’m aware it can be worse. I could go into details about how I got boned, but that’s not the point either of us were making. I have friends that rent and the only ones that didn’t get their nuts put in a vice were already under section 8. One couple just had to uproot again because the landlord sold. Again. Second time in three years. I can’t help them, and I hate it.

Interest rates should never have been that low to begin with. It was basically free money for the wealthy, and it’s how housing became such an investment for big businesses. The rates we have now are still at historic lows, they just feel high compared to the bonkers low rates of the last couple decades. I understand the frustration 100%, but lowering the rates again is NOT the answer at all.

Because those two metrics are meaningless for the average person.

Inflation is trending down… After it skyrocketed and is still way above affordable ranges.

Employment rates are high… But those jobs don’t pay living wages.

Go check how much savings the average American has, check what an average doctor’s visit costs, and then maybe you’ll understand the gloom.

Median figures are more accurate and scarier than average.

For Christmas dinner I vote we just eat the fucking rich

I agree, but we gotta be more thoughtful about it.

I recently had a crazy interaction where I was apparently “The Rich” that needs eaten because I landed a job with a good salary.

Working people aren’t the enemy, needs to be made clear as well. Hell, even corporate headwigs raking in a few million aren’t even close to your enemy in this regard either.

Sounds like jealousy honestly. I’ve had a couple conversations here in the past that because I went out and started my own electrical contracting business instead of working for someone that all of a sudden in the bourgeoise. Like, dude, why in the hell would I keep myself in a position of struggling when I have the skillset and knowledge to make a lot more money, though I’m in a small tourist town so it’s not like I have a bunch of commercial contracts. I have one employee, who makes damn good money for an apprentice. I don’t have health insurance because I can’t fucking afford it without being back in the poor house. I ain’t affording a house anytime soon, and my rent is $2k/month. Most of my gains for this year are going to be diminished because I have to buy a new truck to replace my old car with almost 200k miles on it, and interest rates are fucked. And then taxes take the rest because this country hates people striking out on their own. I make just enough to be slightly ahead of myself year over year, but my wife and I aren’t on a beach in Bora Bora eating bons bons.

Point is, people are angry, and I get it, I’m pretty irritated too. But don’t let people drag you down for your successes just because they’re subscribing to the crabs in a bucket mentality.

No one is asking for deflation. They’re asking for wages that don’t decrease every year due to inflation and companies not giving raises or giving raises so small that it’s still a pay decrease since it’s not keeping up with inflation.

Wages are now out pacing inflation. So it sounds like you’re saying your gloomy about the economy because the president hasnt come in and forced your boss to give you a raise, or hand you a different job with more pay.

Where are you that minimum wages are going up?

Less than 1% of people make minimum wage, so minimum wage isn’t really relevant to any discussion.

Dude, that is the federal minimum, which hasn’t been raised in over 30 years. The states had minimums closer to $10 to $12 in the last 20 years, and many went up to $15 in the last 3 years. That is still much less buying power than minimum wage was at its establishment.

That’s not relevant to any discussion tho. 1.3% of people are at the federal min

I’m here to help and provide information or assistance on a wide range of topics. If something seems weird or if you have a specific question or topic you’d like to discuss, feel free to let me know, and I’ll do my best to assist you!

–ChatSCB

Dude I corrected you on this EXACT BS you posted earlier.

You might just be a chat bot.

If someone is claiming that the rise In minimum wages in many states does not impact the “wages are growing faster than inflation” assertion, it is entirely relevant as many of those people saw a 33% raise over the last few years, and that is way more than 1.3% of wage earners.

What rise in federal min wage are you talking about?

Your number leaves out all of the people whose pay rates are above minimum wage, but are still poverty wages. There is quite a large gap between minimum and poverty, and not in the direction that benefits the working class.

Furthermore, raising the minimum wage leads to people in that gap also getting raises. People can and do benefit tremendously from the minimum wage being raised, even if they have never personally worked at minimum wage. As such, the minimum wage is relevant to far, far more workers than are actually getting it.

Your number leaves out all of the people whose pay rates are above minimum wage, but are still poverty wages.

This is because minimum wage has nothing to do with this discussion

This is my original point.

Furthermore, raising the minimum wage leads to people in that gap also getting raises.

They’re already getting raises because wages are up across the board. There are two jobs for every person right now and that isn’t likely to change for a long time.

I’m sorry, how in the fuck is the minimum wage not related to the fact that rising prices and inflation are causing people to struggle financially? That’s like saying the tides have nothing to do with surfing.

And sure, wages are up, the problem is that if you bother to account for inflation and COL, the purchasing power they provide is down. That’s what people mean when they say “real wages.” I’m sure you know that on some level, even if for purposes of this discussion, you’re pretending not to.

I’m sorry, how in the fuck is the minimum wage not related to the fact that rising prices and inflation are causing people to struggle financially?

Because a small enough people make.minimum wage that it has no bearing on overall price pressures for labor.

Idk why you think I’m “pretending” anything.

Yes it is, it is the absolute floor that someone can be paid.

Yes I am aware. That’s still not relevant whatsoever.

Oh, I thought we were talking about actual wages, not the minimum wage. I’m not even sure how that makes sense in the context.

Most of the places around me pay way less than the actual cost of living, like the average is maybe $12 an hour max but I’d say it’s more like $10. Cost of living estimates vary but for a single adult it’s often around $2500/month, which is far more than you’ll make working at almost anywhere here full time. Even worse, most establishments are actually choosing to short-staff themselves to save money, so most aren’t even looking to increase employment.

So you can work full time and still not have enough to just survive, then if you want to do university/trade school and aren’t elligible for e.g. HOPE then you could have to pick up 2 full time jobs and still somehow have the time/energy left to do college (which most people wouldn’t after that and would just drop out). Some people are able to live with family to reduce or eliminate the housing cost, and a few people are privileged enough to have their family pay for their whole college, but if that’s not the case you’re completely fucked.

And this is in suburban/rural Georgia. I can only imagine how shit it is for someone who can’t afford college, a car, whatever else in a shitty place like Texas or Florida.

One of the things that frustrates me the most about this site (and reddit but it seems even worse here) is the inability of people to follow the context.

The article is about how people, wide spread, are rating the economy as poor despite good economic data. The top level comment is talking about not wanting deflation, but rising wages so they don’t lose out to inflation. I point out that wages are rising and outpacing inflation, so by the metric they used the economy is doing well. Then someone inexplicably brings in the minimum wage (FTR, “Workers in the bottom pay quartile also saw median “real” income gains of 6% since 2019, more than the rest of the income distribution.”[https://www.reuters.com/markets/us/us-job-market-softens-gains-minority-groups-hang-balance-2023-11-27/#:~:text=Workers in the bottom pay,rest of the income distribution] But who cares about the facts? They don’t really mean anything anymore.). I point out that this isn’t about the minimum wage (BTW, I agree that it should be raised) and people still go off on how in their anecdotal experience minimum wage is not enough to get by.

It’s like anything to ignore reality. It’s the same ridiculousness I see from conservatives when I’m debating climate change: just ignore the facts, cherry-pick some data, throw in some anecdotes, and try to reframe the debate.

I’m coming late to this rodeo. I see minimum wage as relevant if the recent statutory raises of the minimum wage are behind the “wages are rising faster than inflation” point. I need to see a distribution chart showing which raises are rising faster, because a lot of pay went from $10 to $15 in the last few years, and that’s a 33% pay increase for those people. What if the people earning between $30 and $60 saw no raises, or worse, lost their jobs and got new ones for less?

I need to see a distribution chart showing which raises are rising faster

I’d be curious to see what your research finds on this too.

Most of the places around me pay way less than the actual cost of living

This is mathematically impossible, unless you live in a place that’s a combination of heavy commuting and like, tourism.

And this is in suburban/rural Georgia

Yeah it’s definitely mathematically impossible. Your standards of living are out of whack with local standards of living.

Even worse, most establishments are actually choosing to short-staff themselves to save money

You live in a dying town.

What does this have to do with what we’re talking about?

Wages may be outpacing inflation, but so have prices for a long time, and wages haven’t reflected increases in productivity since around the 70s or so. In about 2015, I remember looking up some statistics and finding out that wages for the average worker had decreased about 5% since the 70s while CEO compensation had more than doubled, when you account for inflation. The most absurd example I can think of off the top of my head is that, when adjusted for inflation, the cost of a taco from Taco Bell has doubled since the 90s. There’s some great comparisons out there, but some stuff has increased at more than double the rate of inflation since the 80s, with the biggest offender being the cost of college, which has increased by something like 1,153% (if I remember right, it’s been several years since I’ve looked at those statistics).

Plus, local conditions never reflect the national averages/medians, so there are probably areas and industries that are seeing massive booms in wages and work to life balance and such, but there’s others that aren’t and some areas where even booming industries are seeing a decline. The IRS report for 2021 says that 51% of Americans made $15,000 or less that year. During my 20s (around the 2010s), I made $20,000-$30,000 a year working at a local fish market. This would put me probably somewhere around the top 45% of Americans by annual wages comparatively, but due to the high CoL in my hometown, I couldn’t afford to rent a studio apartment. The lowest rent I found in that time was a single room in somebody’s house with “occasional kitchen access” for $1,000 a month. Studio apartments started at $2,000 a month. The average American has something like $20,000 in their bank account, while the median American has $600.

I’m reminded of all the articles I see about people spending their “pandemic savings” where I think to myself, “What savings? The $1,000 check we got that some idiot of a politician said that everybody would be using to go buy a brand new car? 2 years ago they were talking about how we had all gone through the majority of our savings just to keep up with CoL increases.”

Those charts are federal data, and you are correct about the winners of productivity gains. I can tell you why “wages are going up” - many states raised minimum wages from as low as $10/hr to $15, over a period of 3 years. The working poor got raises and are still working poor. Also, these people can’t save their raises. They spend them on basic necessities, so there is a good chunk of economic growth right there. That’s an example of an economic multiplier effect >= 1.0.

Yeah, the “fight for $15” has been going on so long that if minimum wage had kept up with inflation, it would be more like $24-30 an hour now. Just another example of people twisting the numbers to show the conclusions that they want.

I can’t remember the last time people felt good about the economy.

I can… but I was born in the 70s

Maybe it’s because everyone is struggling with high costs of housing, food, and healthcare, among other things, while wages have remained flat and stagnant for decades.

Doesn’t take a genius to figure out that when the economy restabilizes, that doesn’t mean the cost of consumer goods go down or wages go up, it just means the billionaires running the show aren’t losing millions

My son graduated with a degree in economics in 2020 and still hasn’t found a job. He’s not counted in the unemployment numbers because he hasn’t filed for benefits. We need to look at labor participation as well as underemployment instead of the useless stats being used in this article. Real wages have tanked. People are running up debt just to buy groceries. It’s desperate out there.

He’s not counted in the unemployment numbers because he hasn’t filed for benefits.

That’s untrue. From the U.S. Bureau of Labor Statistics:

In the Current Population Survey, people are classified as unemployed if they meet all of the following criteria:

- They were not employed during the survey reference week.

- They were available for work during the survey reference week, except for temporary illness.

- They made at least one specific, active effort to find a job during the 4-week period ending with the survey reference week (see active job search methods) OR they were temporarily laid off and expecting to be recalled to their job.

There are other statistics measuring unemployment claims, but when you hear, “the unemployment rate for Oct 2023 is 3.9%”, that is unrelated to benefits.

Someone feel free to explain these two simultaneous headlines-

I’ll take a stab. This is all conjecture though so pinch of salt, yada yada. Basically, it’s a mix of two or three things.

First, after record breaking inflation in the U.S., the real price of goods/luxuries went up. If everyone bought the exact same thing they bought on black friday last year, we would still have spent more money this year. If you account for our absurd annual inflation this year, “up 7.5%” does not sound very impressive at all.

Second, the economy and general luxury shopping are not necessarily positively correlated. For example, I feel really gloomy about the prospect of ever owning a home. Since I’m just renting, I have more disposable income for luxury shopping. The same could be true for any large purchases like cars, moving out of state, starting businesses, etc. We aren’t reinvesting our money in our economic systems as heavily so it follows that we have more spending cash (not a lot more, but I would certainly have less if I had a mortgage right now).

Third, budgetary reasons. If people do have less money then it follows that a spur of the moment purchase like a new TV would not be made so hastily throughout the year. Or even specifically held off on until the annual sale. It could be that we didn’t get our usual luxuries and are compensating by getting them at a discounted price. It may also just be emotional spending on ourselves, which many people do as a response to feeling ‘gloomy’ in a consumer-first culture, despite that actively making the problem worse.

I’d say you’re spot on with this, I’d love to see the stats of spending prior to black Friday… betting it was lower than all last years.

Plus people are maxing out debt

Probably this, on the heels of: https://lemmy.world/post/8643298

So spending is probably up, but it’s just deepening the debt hole. We’ll see where the bottom of that is soon enough…

The Black Friday article in the picture basically explains the last part of your comment. Everyone waited for sales all year and spent now

Since I’m just renting, I have more disposable income for luxury shopping.

I know no one with a lower rent than my mortgage. Literally no one.

Your mortgage isn’t an option for me (or any renters) though. I get to choose between current rate+price mortgages and current rent prices. Median rent in my county is $1,250. The cheapest non-manufactured home listed on Zillow in my county with the lowest APR advertised (assuming a credit score of 760+) would have a mortgage payment of $1,642. That’s without any of the HOI, taxes, commissions, maintenance, PMI, HOA, or other associated costs.

I likely do, nice to meet you.

I also don’t pay taxes, maintenance, or homeowners insurance. I only have to pay to insure my things.

You can argue those costs are baked into my $1250 rent, and you’re probably right, but I guarantee it’s less than your mortgage and associated costs would be where I live.

People who feel bad buy things to feel better. They might not be able to afford a new house or a car or medical care, but they’ll spend something on gifts.

Also, maybe it’s members of the owning class buying things. They’re getting more money all the time, whether the economy does “good” or not. So they’ve always got money to blow on shit.

Plus it specifically says online sales. Online sales could be up 7.5%, but brick and mortar store sales could be down 50% for all we know.

You can buy a tv for cheaper than a loaf of bread.

Jesus, what kind of bread are you eating?

Only the best ritziest! I saved all year for it.

Sure, no problem. Spending rose by 7.5%, inflation until recent months was at 10%. Net real sales is down by 3.5%. People are spending more for less. This is why we are gloomy. Still, I recognize things are getting better on the macro level.

I really wish news outlets would stop pretending this is some big mystery. Shit is too expensive.

IMO it’s the inverse, we don’t make enough. The 1% have been keeping wages stagnant. We can’t stop the price of goods from going up, but we can increase pay from it sharing the bottom line. As soon as interest rates re-appeared, all the free money that was sitting around for the taking disappeared. Sooner than later, we’ll be paying micro-transactions for crap that was previously able to be paid for by selling us ads. But that money isn’t coming back to us.

It is difficult to get a man to understand something when his salary depends on his not understanding it.

- Upton Sinclair, 1934